In the coming December

Amazon’s three compliance regulations will come into effect

Failure to comply with regulations on time may lead to the risk of being removed from the shelves and having your account banned.

European and American sites are available!

Compliance issues are urgent

At this time point, most sellers are focusing on the layout and preparations for Black Friday and Cyber Monday.

But don’t forget, Amazon will have three very important compliance issues that will take effect in December. Once compliance requirements are not met on time, it will be a trivial matter for the product to be removed from the shelves, and in serious cases, the direct account will be lost. So be sure to pay attention!

These 3 are:

European GPSR regulations, US tax identity information, and restrictions on products lacking COO information.

Although the final dates for these compliances are all in December, in fact, many sellers have been affected before. You can imagine how serious the failure to comply before the deadline will be.

“Guys, are there any European stations? How can I break the EU product compliance policy that requires updated information?”

“Compliance has been talked about for so long, so hurry up and do it as required.”

“(The above problem is caused by) lack of compliance documents”

Complying with compliance requirements is the top priority to ensure the steady development of business. Let me emphasize the specific time and content of these three compliances!

Compliance specific information

1. European GPSR compliance, officially effective on December 13

The General Product Safety Regulation (GPSR) came into effect on December 13 this year! If the standards are not met on time, not only will the newly entered products be affected, but even the goods in transit will face the risk of being removed from the platform or even removed. There is currently less than a month left. Sellers are also requested to speed up the compliance process and be sure to successfully complete all compliance matters before the critical time points set by the platform.

2. Update your U.S. tax identity information before December 30

According to the regulations of the U.S. Internal Revenue Service, non-U.S. taxpayers need to provide Amazon with the latest W-8 form to be exempt from U.S. tax filing requirements. IRS Form W-8 expires on December 31, three years after the seller provides the form to Amazon.

When prompted, overseas sellers need to re- accept tax information collection to submit new forms. If you receive a reminder from Amazon indicating that your W-8 form is about to expire or has expired, you must collect your tax identity information again.

If you are a non-U.S. tax resident and cannot provide a current W-8 form, Amazon will suspend your selling privileges until you provide updated tax status information.

Failure to update tax information as required will result in an account violation of Amazon selling policies and your account will be suspended until you provide updated tax status information.

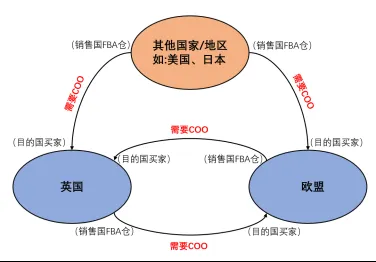

3. Products lacking COO information will be restricted, effective December 31

This is the compliance of the European station and the British station. Sellers are required to complete the country of origin/origin COO information before December 31, 2024.

In accordance with EU-UK customs and trade regulations, Amazon will collect country of origin/country of origin (COO) information for products that pass through the Fulfillment by Amazon ( FBA ) last-mile logistics program:

If the country/origin information is not provided for the product ( SKU level), it will have the following effects on your Amazon logistics products:

New products cannot be successfully created, and all existing products are restricted from entering and exiting the EU and UK.

Sellers who have not yet completed the COO compliance requirements will receive the following reminder on the seller platform. Please click “Confirm” before December 31, 2024.

And submit your COO information as soon as possible as required to prevent your products from being restricted due to missing COO information after December 31, 2024, and being unable to enter and exit the EU and the UK.

Finally, Amazon takes a certain amount of time to review the information. It is recommended that sellers complete compliance operations in advance to avoid adverse effects on accounts and ASIN sales permissions.